Analysis of the progress of my country's transformation finance practice

In the process of promoting the "double carbon" goal, not only must we vigorously develop green and low-carbon industries, but the transformation of high-carbon industries and regions to low-carbon should also be worthy of attention. The two need to coordinate and advance together. Green finance tends to support "pure green" or "almost pure green" projects, while transformation activities are difficult to support. As an expansion of green finance, transformation finance is more in line with the characteristics of my country's energy structure and the reality of transformation and development. In February 2022, the first meeting of finance ministers and central bank governors of the Group of Twenty (G20) advocated that all parties should develop transitional finance to support orderly green transformation. Therefore, the exploration and practice of transition finance have important practical value.

1. The connotation of transformation finance

Regarding what is transition finance, international and domestic officials and scholars have given corresponding definitions. In March 2020, the European Commission's Technical Expert Group pointed out in the "EU Sustainable Finance Classification Scheme" that transition finance is to achieve climate change mitigation goals, make significant contributions in sectors that have not yet provided low-carbon alternative products, and meet the needs of supporting transformation. Financial activities. Domestically, in January 2022, the government of Huzhou City, Zhejiang Province issued relevant documents that believed that transformation finance is an innovative tool specifically to provide financial services for the low-carbon transformation of carbon-intensive industries. Relevant scholars believe that transition finance is to cope with the impact of climate change, with the main goals of improving the green financial system and supporting the transformation of high-carbon enterprises to low-carbon. Based on clear dynamic technical path standards, it uses diversified financial instruments to provide market entities, economic activities and asset projects, especially financial services provided by traditional carbon-intensive market entities, economic activities and asset projects to transition to low-carbon and zero-carbon emissions [3].

Based on the above, the concept of transition finance clarifies three aspects: First, the support objects of transition finance. On the one hand, the support objects of transformation finance include projects or activities that have low-carbon and carbon-reduction effects, and on the other hand, they also include relevant entities whose emission reduction goals are consistent with the Paris Agreement or national carbon neutrality goals. Therefore, the support scope of transformation finance covers areas that have not yet been covered by green finance such as brown industries and high-carbon industries, and is more extensive and flexible than green finance. Second, the transformation goal. The goals for transformation activities in transformation finance should be operable. Operability means that transformation goals are quantifiable, disclosed, and verified and verified by third-party agencies. Third, support strength. The support for transformation finance is generally linked to the transformation effect, while the support for green financial instruments does not depend on this.

Transformation finance can promote enterprises to reduce carbon emissions by improving the carbon reduction technology level of high-carbon enterprises. The carbon emission reduction effect produced in synergy with the carbon emissions trading mechanism can effectively offset the impact of a single implementation of the carbon emissions trading mechanism on enterprises. The net impact of increased carbon emissions [1].

2. The practical progress of my country's transformation finance

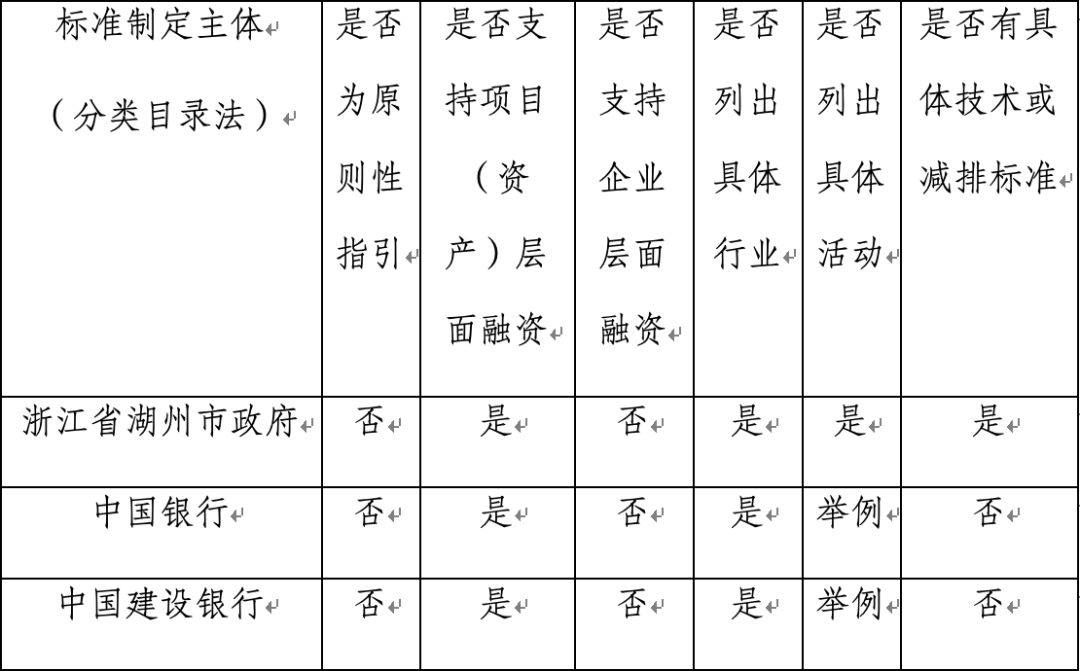

Regarding the practice of transformation finance, in 2021, the "Notice on Carrying out Innovation Pilots Related to Transformation Bonds" issued by the Association of China Interbank Market Dealers includes four aspects: the use of raised funds, disclosure of transformation information, third-party evaluation and certification, and management of raised funds. Relevant requirements are clarified. In 2022, the People's Bank of China proposed at the 2022 research video conference held to support green and low-carbon development as the main line, continue to deepen research on transformation finance, and achieve an orderly and effective connection between green finance and transformation finance. In the same year, Huzhou City, Zhejiang Province issued the "Implementation Opinions on Deepening the Construction of a Green Finance Reform and Innovation Pilot Zone to Explore the Construction of a Low-Carbon Transformation Financial System", which pointed out that the development path of transformation finance should be systematically planned and the development of transformation finance should be systematically promoted. It also took the lead in issuing the "Huzhou Transformation Financial Support Catalog (2022 Edition)", which covers nine high-carbon emission industries such as textiles and papermaking, and sets benchmark values and target values for transformation activities. Specific technical standards and paths are stipulated. Table 1 lists some of my country's existing transformation financial standards.

Table 1 my country's existing transformation financial standards

Source: Gu Baozhi, Li Zhuoyu, Zheng Mengting. The development status and practical path of my country's transformation finance under the "double carbon" goal [J]. International Economic Cooperation, 2023(2):70-81.

At present, my country's transformation standards are not principles. They all support project-level financing but do not support enterprise-level financing. At the same time, specific industries and activities need to be listed. Only the local government of Huzhou City has stipulated technical or emission reduction standards.

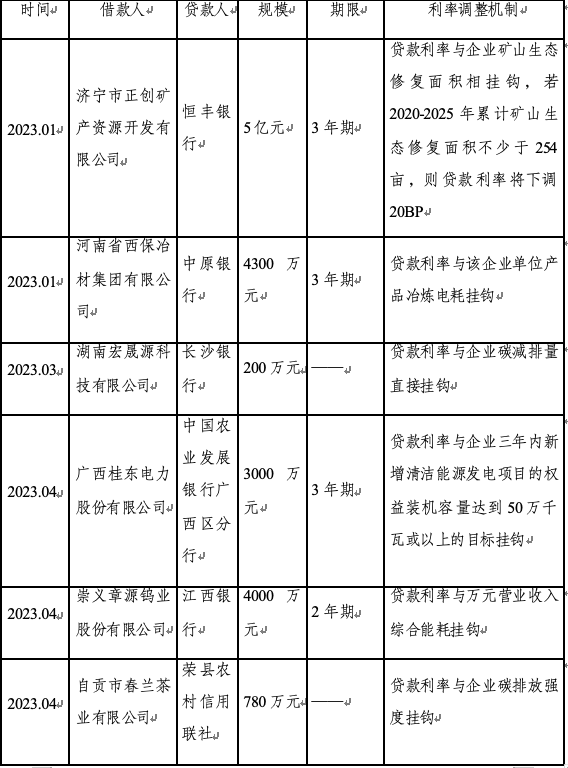

In terms of transformation financial products, the existing transformation financial products at this stage mainly include sustainable development-linked credit, transformation bonds, sustainable development-linked bonds and sustainable development-linked bonds, etc. Among them, the more mature development is sustainable development-linked credit. According to the Sustainable Development Linked Credit Principles (SLLP), sustainability-linked credit refers to any type of loan instrument or alternative financing method that can encourage companies to achieve vision and pre-set sustainable development goals. Lenders of sustainability-linked loans can pre-set key performance indicators to evaluate the company's sustainable development performance, and their completion is measured through specific Sustainable Development Goals (SPTs). At the same time, sustainability-linked loans do not limit the use of funds.[4]. Table 2 lists relevant cases of sustainable development-linked credit in my country.

Table 2 Credit cases linked to sustainable development in my country

Source: Compiled based on public information

Based on Table 2, the financing entities of my country's sustainable development-linked credit are mainly enterprises in high-carbon industries such as energy, power, construction and metallurgy, and the funds are mainly invested in carbon reduction and transformation in the environmental field, especially green buildings and renewable energy power generation and other aspects. At the same time, the scale of loans linked to sustainable development is relatively small, mainly concentrated below 100 million yuan, and the loan term is mostly 2 - 3 years. In terms of interest rate adjustment mechanisms, most companies use a single internal indicator to link interest rates, lacking consideration of social, corporate governance and external indicators, such as ESG rating results of third-party institutions.

references

[1]Ding Pan, Li Ling, Pan Qiurong, Chang Yingwei. Environmental regulation, transitional finance and corporate carbon emission reduction effects [J]. Southern Finance, 2023(8):41-55.

[2]Gu Baozhi, Li Zhuoyu, Zheng Mengting. The development status and practical path of my country's transformation finance under the "double carbon" goal [J]. International Economic Cooperation, 2023(2):70-81.

[3]Wang Ren. Research on the development path of my country's transformation finance under the background of "double carbon"[J]. Theoretical Journal, 2022(4):100-108.

[4]Xu Hongfeng, Yi Lei. Innovation of domestic and overseas transformation financial products, comparative analysis and development suggestions [J]. Southwest Finance, 2023(9):15-31.