The 2024ESG Global Leaders Conference opens grandly, and the academic community, financial community, business community, etc. jointly discuss ESG

Approved by the State Council, the 2024 Global Leaders Conference on Environmental, Social and Corporate Governance (hereinafter referred to as the "2024ESG Global Leaders Conference"), hosted by CITIC Group and Sina Group and hosted by Sina Finance and CITIC Publishing Group, officially opened in Huangpu District, Shanghai City on October 16. The theme of this conference is "Promoting Global ESG Cooperation, Development and Win-Win".

On the morning of October 16, Municipal Party Secretary Chen Jining attended the opening ceremony of the 2024 Global Leaders Conference on Environment, Social and Corporate Governance and delivered a speech. Chen Jining pointed out that Shanghai will thoroughly implement Xi Jinping Thought on Ecological Civilization, accelerate the improvement of green and low-carbon development mechanisms in accordance with the strategic deployment of the Third Plenary Session of the 20th Central Committee of the Communist Party of China, improve the regulatory system, promote industry self-discipline, improve the level of corporate governance, and create a good system and environment for corporate environment, society and corporate governance development. Gu Shengzu, Vice Chairman of the 13th National Committee of the Chinese People's Political Consultative Conference, and Gao Zhidan, Director of the State Sports General Administration, attended the opening ceremony.

Xi Guohua, Chairman of CITIC Group, Cao Guowei, Chairman and CEO of Sina Group, and Tu Guangshao, Co-Chairman of the ESG Leaders Organization Forum, spoke on behalf of the organizers. In addition, Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), delivered a video keynote speech.

At the conference,"Practicing the Path of Sustainable Development-2024 Shanghai ESG Development Report" was officially released. The report was led by the Shanghai School of Advanced Finance of Shanghai Jiao Tong University (hereinafter referred to as "Gao Jin"). It is the first systematic report on the development status of local ESG in China, contributing "Shanghai Wisdom" and "Shanghai Plan" to sustainable development across the country and even the world.

In addition, important guests from academic, financial, business and other fields appeared at the conference. Presidents of five major state-owned banks, and guests from many companies such as China Eastern Airlines and China Pacific Insurance delivered wonderful speeches.

ESGIt is accelerating to become a "must-answer question"

According to reports released by Shanghai, Chen Jining pointed out that China is an important practitioner and promoter of global sustainable development. In recent years, Shanghai has strengthened ecological and environmental protection, accelerated industrial upgrading and structural adjustment, and strived to enhance its sustainable development capabilities in accordance with President Xi Jinping's important instructions and central government decisions and arrangements. On the new journey, Shanghai will focus on promoting green transformation of enterprises. Focusing on improving basic support, we will accelerate the planning and construction of new energy systems, improve the carbon market trading system, and explore the establishment of carbon emission statistical accounting, product carbon labeling certification, and carbon footprint management systems.

Xi Guohua, chairman of CITIC Group, said that ESG is accelerating the transformation from "multiple choice questions" to "must-answer questions." He advocates supporting more countries to establish ESG policy systems, disclosure standards and evaluation methods that are in line with national conditions and in line with international standards, and advocates that China companies actively participate in the formulation of international standards and help enhance the influence of China's ESG system.

Cao Guowei, Chairman and CEO of Sina Group, said that in recent years, frequent multiple crises such as public health, climate change, biodiversity, and geopolitics have caused the cause of global sustainable development to encounter unprecedented obstacles. ESG consultation has never played a more important role in solving important issues in the global sustainable development process and helping companies cope with the multi-faceted risks they face.

Tu Guangshao, co-chairman of the ESG Leaders Organization Forum, said that in the process of sustainable development, including the process of practicing ESG, we have many development opportunities, but on the other hand we encounter many challenges. From the perspective of the international community, how to truly and continuously make the practice of ESG and sustainable development have more momentum through more practice and more promotion is also a common task for the world.

International guests share global perspectives

Kristalina Georgieva, managing director of the International Monetary Fund (IMF), said China has always been firmly committed to achieving its climate goals. China has made rapid progress in achieving these goals, driven by prudent policies, including the Carbon Emissions Trading Scheme (ETS) and emissions quota trading. These policies can make it easier to achieve climate goals, while also increasing revenue to achieve climate goals.

Aaron Ciechanover, winner of the 2004 Nobel Prize in Chemistry, said that drug price and bioethics are two major issues facing modern medicine. Expensive drugs may not be universally available, and the protection of genetic privacy is also an important issue.

George Walker, Chairman and CEO of Lubemai Group, said that ESG factors are an important driving force for long-term investment returns. Lubermai has always been at the forefront of providing clients with diversified ESG-related investment options. We are very pleased to support the development of ESG investment in China, especially after China announced that it will achieve its carbon neutrality goal by 2060, and this trend has further accelerated.

The financial industry seeks sustainable development together

In the keynote speech session of "Building a Sustainable Development Financial Institution", Liu Jun, President of the Industrial and Commercial Bank of China, said that ESG has achieved rapid development in the global response to many issues such as climate change, biodiversity loss, and development inequality. However, Liu Jun also reminded that at the same time, another phenomenon worthy of attention is that the current global ESG development has slowed down or even regressed in some aspects.

Wang Zhiheng, President of the Agricultural Bank of China, said that international sustainability standards are being widely adopted around the world. In recent years, my country has intensively introduced a series of standards and policies related to sustainable development. Agricultural Bank actively implements various regulatory requirements for sustainable development and formulates disclosure standards, uses disclosure to promote internal management and external communication, and actively responds to new requirements for sustainable development.

Zhang Yi, president of China Construction Bank, said that sustainable development is finance committed to improving people's livelihood and well-being of society. China Construction Bank adheres to finance for the people, enhances the convenience and accessibility of financial services with high-quality financial supply, actively promotes scientific and technological innovation, uses science and technology finance to promote the development of new quality productivity, and builds a "stock, loan, debt, insurance, and rent" service system, create a new model of a regional science and technology financial innovation center, promote services in equity, bonds, insurance and other fields, and inject a steady stream of financial power into technology companies.

Zhang Baojiang, President of Bank of Communications, said that transformation finance is the proper meaning of the sustainable development of the banking industry. Doing a good job in green finance and supporting sustainable economic and social development is an important manifestation of commercial banks, especially state-owned banks, complying with the global ESG development trend and practicing the political and people-oriented nature of financial work.

Liu Jianjun, President of Postal Savings Bank of China, said that building sustainable financial institutions is an important way to achieve high-quality development, serve the real economy, promote the construction of a financial power, promote high-level financial opening, and expand financial service space.

Fu Fan, chairman of China Pacific Insurance (Group) Co., Ltd., said that high-quality development is a development centered on politics and people, a development that prioritizes quality and efficiency, a development with controllable risks, and a sustainable development, and the ESG concept serves as an important starting point for achieving sustainable development.

Two major exchanges discuss ESG practices

In the speech session on "Doing Five Major Articles to Promote High-Quality Financial Development", Zhang Bei, deputy director of the Research Bureau of the People's Bank of China, said that in recent years, the People's Bank of China has thoroughly implemented Xi Jinping's Thought on Ecological Civilization, focusing on leveraging the three major functions of green finance: resource allocation, market pricing and risk management, accelerating the improvement of the green financial system and supporting high-quality and sustainable economic development.

Chen Yong, deputy director of the Shanghai Headquarters of the People's Bank of China China, said that doing a good job in finance is of great significance to high-quality financial development and sustainable and healthy economic development, and is very consistent with the ESG concept. The "Five Big Articles" are the essential requirements for financial services to the real economy, and the "Five Big Articles" are an important starting point for the transformation and upgrading of the financial industry.

Yuan Duoran, chairman of the Listing Review Committee of the Shanghai Stock Exchange, said that as an important member of the capital market, the Shanghai Stock Exchange has always been committed to promoting ESG concepts and guiding ESG practices. In recent years, the policy supply for ESG development has accelerated significantly. The capital market has used ESG as the starting point to improve the quality of listed companies, with remarkable results.

Li Hui, deputy general manager of the Shenzhen Stock Exchange, said that the Shenzhen Stock Exchange has formulated and implemented the "Work Plan for Promoting the Construction of a Sustainable Exchange" to integrate sustainable development elements into strategic decisions and various business lines. In the next step, the Shenzhen Stock Exchange will fully implement the spirit of the 20th National Congress of the Communist Party of China and the Second and Third Plenary Sessions of the 20th Central Committee of the Communist Party of China, completely, accurately and comprehensively implement the new development concept, and under the unified leadership of the China Securities Regulatory Commission, accelerate the construction of a world-class exchange to create a sustainable exchange benchmark.

ESGGuide sustainable market construction

Zhang Xiangchen, Deputy Director-General of the World Trade Organization (WTO), said that at present, digitalization has profoundly changed the pattern of global trade. E-commerce and cross-border data flows provide countries around the world, especially small and medium-sized enterprises, with new opportunities to participate in the global market. As the main setter of global trade rules, the WTO is actively promoting the negotiation of digital trade rules, aiming to address barriers to cross-border data flow, e-commerce, consumer protection, etc. in various countries.

He Shilan, head of ESG and Climate Business for MSCI Asia Pacific and head of South and Southeast Asia, said that Asia's importance in the global economy has become increasingly prominent and has become a key driver of climate-related innovation. In particular, China is a global leader in renewable energy and electric vehicle production.

Harvard professor Jason Furman, former chairman of the White House Council of Economic Advisers, said climate change is the biggest challenge facing the planet. Carbon emissions have externalities. When companies decide how to produce and consumers decide how to live, they fail to consider the costs of carbon emissions, which affect everyone around the world.

Soren Toft, CEO of MSC Mediterranean Shipping, said that Mediterranean Shipping has been a staunch partner of China since 1998. We have witnessed with our own eyes the rapid growth achieved by China and worked together to address important challenges such as decarbonization. Our cooperative partnership reflects our common commitment to mutual benefit and global cooperation.

Marco Lambertini, convener of the Biodiversity Platform and former Director-General of the World Wide Fund for Nature (WWF), said we must change our direction and adopt an approach that no longer comes at the expense of nature. Benefit from nature is not a slogan, but a global goal.

Chang-Hee Lee, director of the ILO's China and Mongolia Bureau, said that the ILO has established international labor standards and supervised their implementation by member states, which is also the core task of the ILO. To date, the International Labor Organization has formulated 190 international labor conventions, which are closely linked to the international trading system.

Cowo, chief operating officer and executive producer of Pudefo Asia, said that the health factor is very important and indispensable. It can avoid employee dissatisfaction, but it cannot motivate employees. It is just a basic factor. Motivation elements can really increase employee satisfaction and make them feel very excited, employee engagement will increase, and their engagement will increase.

Capital market practices responsible investment

Yan Bojin, chief risk officer of the China Securities Regulatory Commission and director of the Issuance Supervision Department, said that the capital market field has always attached great importance to guiding listed companies to improve their performance in terms of environment, social responsibility, corporate governance, etc., in order to help the company itself, as well as the economy, society and environment. Sustainable development. The China Securities Regulatory Commission regards the disclosure of sustainable development information of listed companies as a basic link in promoting sustainable development and continues to improve relevant rules.

Yang Huahui, chairman of Industrial Securities, said that the ESG investment concept has gradually been known and recognized by asset management institutions. Industrial Securities, as an early securities trader in China, began to study overseas socially responsible investment and ESG concepts 17 years ago, and issued my country's first socially responsible investment theme fund in 2008.

Liu Yuanrui, president of Changjiang Securities, said that in recent years, ESG has been one of the focuses of attention of all parties, and everyone is working hard to get closer to this aspect. Although the topic of ESG investment has cooled down slightly when the market fluctuates, ESG is still a general development trend in the medium and long term.

Li Wen, chairman of Huitianfu Fund Management Co., Ltd., said that my country's development of ESG responsible investment is of great importance. It is not only an important path to further comprehensively deepen reforms and promote sustainable economic and social development, but also an effective means for the capital market to improve the governance of listed companies and boost investors. It is also an inevitable requirement for institutional investors to respond to the spirit of the Central Financial Work Conference and write a good article on "green finance".

Wu Lanjun, chief strategist of global sustainable investment at Morgan Asset Management, said that in the face of severe challenges such as rising global temperatures and reducing biodiversity, capital and capital markets should become key forces in solving problems. She emphasized that patient capital and responsible investing should be a new combination of investment strategies, not just one of many strategies, and she said that ESG should be involved in various investment strategies.

Wu Huimin, head of the ESG Office of CICC, executive director of the CICC Research Institute, and executive head of the research department of CICC, said that China's green transformation has made remarkable achievements. The cost of many new energy power generation is already lower than that of coal-fired electricity prices. The green premium has turned negative, while China's installed new energy capacity leads the world.

Huang Danqi, head of ESG consulting and integration at Schroeder Investment in the Asia-Pacific region, said that climate change issues are closely related to patient capital. Schroeder Investment has been committed to helping customers understand the risks and opportunities brought by climate change and excessively reduce carbon intensity may lead to higher proactive risks, so an appropriate carbon emission reduction path needs to be found.

Anthony NEOH, an independent director of CITIC and former chairman of the Hong Kong Securities and Futures Commission, said that GRI (Global Reporting Initiative) and GHG (Greenhouse Gas) standards are global reporting standards. These standards are recommendatory and good companies can choose to use them, but require a large amount of capital and resource investment.

Financial industry explores ESG transformation

Sheng Ruisheng, Secretary of the Board of Directors and Brand Director of Ping An China, said that the recent policy direction will be more focused on residents 'consumption, combined with the new development pattern of "dual circulation", in order to enhance the internal circulation of a higher-level super-economy. There will be a lot of room for green and low-carbon consumption trends, which is also the only way to move from a production-oriented society to a consumer-oriented society.

Jiang Caishi, executive director and vice president of People's Insurance Company of China, said that by accelerating ESG transformation and serving the sustainable development of the whole society, insurance can play an important role in ensuring green risks, carrying out green investment, and ensuring people's livelihood.

Xu Chongmiao, chief compliance officer of China Life Insurance Company, said that ESG is the development direction of financial enterprises in the future and an important starting point for achieving harmony and unity between individual development of enterprises and overall social progress. It not only reflects the enterprise's responsibility to the public, but also realizes its own internal needs for high-quality development.

Bai Li, chairman of Great Wall Life Insurance Co., Ltd., said that adapting to the new era, the transformation of life insurance is imperative. After experiencing a long period of rapid growth, China's economy is now facing a historic transition from rapid growth to high-quality development. In this special and critical period, implementing the ESG strategy is very important for promoting the transformation of the financial industry and achieving sustainable and high-quality growth.

Huang Jinlao, chairman of Sushang Bank, said that China has successively established 19 private banks since 2014. It has been ten years since today. These ten years are the ten years when China's digital technology has flourished. Private banks make full use of digital technology to seek niche business opportunities in the market. The inclusive and open regulatory attitude has also provided development space for private banks.

Xiong Bihua, president of JPMorgan Chase Bank (China) Co., Ltd., said that on a global scale, ESG's focus in the financial sector continues to grow, and this trend will be particularly significant in 2024. From a policy perspective, taking the Asian market as an example, many countries have issued new regulations on the sustainable development disclosure of listed companies this year or solicited opinions from the public. It is expected that these new regulations will be gradually implemented from 2025 to 2027.

Song Yuesheng, vice chairman and president of Hang Seng China, said that for the banking industry, green development and socially responsible investment will become the entry points for future layout. There are huge opportunities in sub-areas such as green energy, clean transportation, industrial energy conservation, clean production, sustainable agriculture and solid waste treatment.

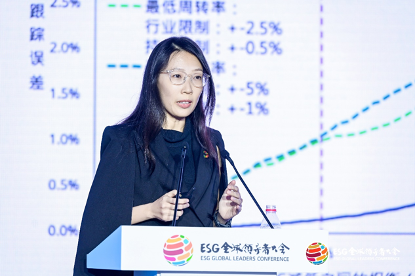

Shanghai ESG Development Report Released

At the conference, the "Practicing the Path of Sustainable Development-2024 Shanghai ESG Development Report" led by the Shanghai School of Advanced Finance of Shanghai Jiao Tong University was officially released.

This report is the first systematic report on the development status of local ESG in China. It was led by Gao Jin and collaborated with many companies and institutions. It was compiled through a large number of research and systematic sorting, combined with the latest policies, data and cases.

The report systematically reflects the current situation of ESG development in Shanghai, summarizes the achievements and challenges faced by all participants in the innovative practice of ESG, and explores the direction and strategies for ESG's future progress, providing sustainable development for the country and even the world. Contribution to "Shanghai Wisdom" and "Shanghai Plan".

The 2024 ESG Global Leaders Conference was co-sponsored by CITIC Group and Sina Group, and hosted by Sina Finance and CITIC Publishing Group. Many entrepreneurs also delivered wonderful speeches.