Faced with the "double carbon" goal, how should my country's steel industry accelerate its low-carbon transformation and move forward towards "green"?

With the advancement of the "double carbon" goal, the government has successively introduced various policies to integrate industry and finance, improved the transformation financial framework, and introduced transformation financial tools. In this context, my country's steel industry is accelerating its low-carbon transformation, riding the wind and waves, and moving forward in pursuit of "green".

In the process of achieving the "double carbon" goal, reducing carbon dioxide in steel is crucial. First of all, as a major carbon emitter, my country's steel industry accounts for 15% of the national total carbon emissions, second only to the power industry. Secondly, my country not only accounts for 54% of the global total crude steel output, but also ranks first in the world in consumption. Calculations show that if the world plans to achieve the goal of no more than 1.5 ° C heating by the end of this century, my country's steel industry must achieve carbon neutrality by 2050. The goal is ambitious and full of challenges.

With the cyclical adjustment of the steel industry, my country's steel companies have reduced production capacity in recent years to reduce carbon emissions. However, this marginal adjustment is not enough to achieve complete decarbonization. In fact, complete decarbonization requires steel companies to carry out multiple technological innovations, including improving energy efficiency, material efficiency and increasing the use of scrap steel in the short and medium term, and adopting technologies such as hydrogen metallurgy and carbon capture in the long term. In this context, my country's steel companies have successively launched low-carbon transformation processes, among which leading steel companies are the most active, which is reflected in their adoption of innovative low-carbon equipment and energy efficiency improvement processes.

Capital is an essential element for the low-carbon transformation of the steel industry. The amount required is huge, and the current gap is huge. When introducing funds to empower the low-carbon transformation of the steel industry, investors will conduct transformation assessments of steel companies to judge the credibility of their transformation goals and the carbon neutrality of their transformation paths, etc., before granting funds to the companies that meet the standards.

So, what is the "green" standard for the steel industry? What are investors looking for "green" assessments? What are the "green" actions for steel companies? In response to these "green" issues, the author has conducted research and hereby analyzes them in order to inspire valuable ideas and trigger discussion.

Technical Guidelines for Transformation of Steel Enterprises

In order to achieve the goal of carbon neutrality, governments of various countries have successively launched transformation technical standards for different industries to guide enterprises in low-carbon transformation, while guiding the precise flow of financial resources to relevant key areas.

For sustainable economic activity, the EU launched the world's first classification standard in 2020. The standard first defines six major environmental goals, namely climate change mitigation, climate change adaptation, sustainable use and protection of marine resources, circular economy, pollution prevention and control, and ecosystem protection and restoration. The standard also requires that sustainable economic activities must meet the principles of significant contribution, no major harm, maintaining minimum social governance guarantees, and meeting technical screening standards.

Based on the above framework, the European Union has introduced the Climate Authorization Act to formulate specific technical screening criteria for climate mitigation and adaptation activities in various industries. For example, in the steel industry, climate mitigation and climate adaptation activities include electric arc furnace processes, and the carbon emissions per ton of high-alloy steel and carbon steel produced by electric arc furnaces shall not exceed 266 tons and 209 tons of carbon dioxide equivalent respectively. and scrap steel input shall not be less than 70% and 90% of the total output respectively.

After the European Union, the G20 and China have successively proposed a transitional financial framework and guidance on transitional finance for the steel industry.

Regarding the G20, member states released the "G20 Transformation Financial Framework" at the summit in 2021, making transformation finance an important financing method for the transformation of high-carbon industries. In order to avoid the transitional financing dilemma caused by financial institutions withdrawing funds from high-carbon industries, governments of various countries have launched a transitional finance catalog based on the experience of the EU classification.

In my country, although the People's Bank of China has indicated that it will launch transitional financial standards for four key industries such as steel, it has not yet been released. While waiting for the "national standard", five provinces and cities in China have successively launched "landmarks" last year, including the "Guidelines for Transformation Finance of the Steel Industry in Hebei Province (2023-2024 Edition)" and "Shanghai City Transformation Finance Catalog (Trial)."

The Hebei Guidelines are my country's first guidelines specifically for the steel industry, which list 176 steel smelting technologies that meet transformation standards. The Shanghai Catalog follows the EU classification and develops technical screening indicators for transformation activities. Specifically, the Shanghai Catalog lists transformation technologies for the steel industry using a positive list method, and formulates carbon reduction access values and advanced values respectively. The former is the basic threshold that transformers must meet, and the latter is the optimization ideal. The Shanghai catalog also shows the energy conservation and carbon reduction paths of the blast furnace process for steel smelting, including extreme energy efficiency, technical process improvement, intelligent management, resource recycling, renovation of public and auxiliary facilities, carbon capture, utilization and storage, etc., while the entry value of low-carbon transformation is 370 kilograms of standard coal/ton, and the advanced value is 361 kilograms of standard coal/ton.

Based on the technical guidance for transformation finance in various countries, there are three main means for decarbonization for the steel industry to achieve the 2050 carbon neutrality goal. One is to improve energy and material use efficiency, and the other is to increase the utilization of scrap steel through scrap steel/arc furnace production routes., the third is the development and expansion of new production technologies. Specifically, if 2030 is regarded as the watershed in the short, medium and long term, the first method has limited carbon reduction effect and is suitable for use in the short and medium term. The second method mainly focuses on the reuse of scrap steel. It is not a radical plan and is only suitable for use in the short and medium term. The third means relies on new technologies to replace existing blast furnace/converter production equipment, especially through green hydrogen smelting iron, carbon capture and other technologies to completely decarbonize, and is suitable for long-term use.

Steel transformation assessment of financial institutions

In addition to identifying transformation technologies and activities, financial institutions will consider the credibility of their transformation plans when evaluating the transformation of steel companies. In particular, steel is an asset-heavy industry, and the decarbonization process involves the discontinuation of a large number of high-carbon assets and the investment of low-carbon assets. In order to avoid carbon lock-in and stranded assets, steel companies must plan and layout their decarbonization process in advance. Therefore, when financial institutions assess the credibility of steel enterprise transformation plans, they will pay attention to their specific processes and whether they can be aligned with carbon neutrality goals.

In particular, the ultimate goal of an enterprise's low-carbon transformation is to achieve carbon neutrality with net-zero emissions, so an "alignment assessment" should be carried out to meet the goals of its transformation plan. So far, several assessment frameworks have been developed internationally, of which the investor-initiated Climate Action 100+(CA100 +) is the most popular. This article takes CA100 + as an example to illustrate the key points of this type of evaluation.

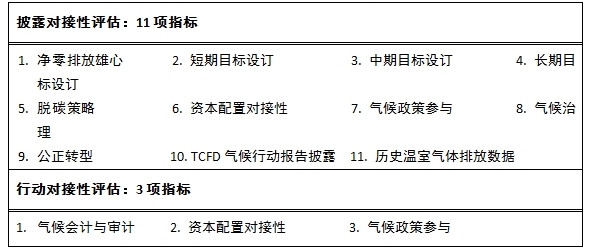

Table 1 Evaluation of carbon neutrality docking performance of CA100 +

As shown in Table 1, the matching evaluation of CA100 + consists of two parts, one part is related to the company's disclosure matching, and the other part is related to the company's action matching. The former contains 11 indicators and is mainly judged based on the scoring results of the Transition Pathway Initiative (TPI) and FTSE Russell. The latter includes three indicators, which are mainly based on the assessment results of the Impact Map, the Carbon Tracking Initiative and the Rocky Mountain Institute. CA100 + uses a traffic light schematic method to score each indicator: a green light means that the company meets relevant standards or is aligned with carbon neutrality goals, a yellow light means that the company meets some standards but needs further improvement, and a red light means that the company does not meet the standards and requires major improvement.

In terms of disclosure compatibility, CA100 + mainly focuses on whether the quality of corporate disclosure is consistent with carbon neutrality goals, so it will evaluate its target setting and decarbonization strategies. Target evaluation is related to the ambition shown by steel companies when formulating carbon neutrality goals, as well as the progress of formulating their short-term (2023 - 2026), medium-term (2027 - 2035) and long-term (2036 - 2050) emission reduction goals. The evaluation of decarbonization strategies is related to the overall strategy of steel companies, as well as quantifiable emission reduction measures and the use of negative emission technologies. The focus of the capital allocation assessment is on steel companies 'disclosures on decarbonization related capital expenditures, including whether they plan to phase out high-carbon assets and whether they invest in climate solutions. Climate policy participation assessment is related to enterprises 'direct or indirect participation in climate policy formulation, climate governance assessment is related to the ability of enterprises' boards and management to respond to climate change, and fair transition assessment is related to enterprises 'handling of employees and communities affected by their decarbonization. In addition, CA100 + is also concerned about whether steel companies disclose in accordance with TCFD recommendations, so it will evaluate their climate-related disclosures, carbon emission disclosures, etc.

In terms of action docking, the focus of CA100 + has shifted from corporate disclosure to corporate actions. Judging from the results of the actions, whether corporate transformation is aligned with carbon neutrality goals, there are three docking assessments involved. The first is the docking assessment between climate accounting and auditing, which mainly focuses on whether the financial statements and audit reports of steel companies incorporate climate risks and align with carbon neutrality goals. The second is the docking evaluation of capital allocation, which mainly focuses on whether the capital allocation plan of steel companies is aligned with the carbon neutrality goal, as a supplement to disclosing the carbon footprint performance in the docking evaluation. The third is the docking assessment of climate policy participation, which mainly focuses on the direct climate policy participation of steel companies or indirect climate policy participation through industry organizations, and whether they are aligned with carbon neutrality goals.

It must be emphasized that when assessing whether the transformation of steel companies can be aligned with the goal of carbon neutrality, the evaluator not only considers the company's past performance, but also considers its future development. The former is reflected in the actual carbon emission trajectory of the enterprise, while the latter is reflected in the enterprise's short-and medium-term capital investment proportion and cost planning, as well as long-term direct investment in new technologies and green patent research and development. Forward-looking information provided based on future development assessments can help investors more accurately grasp the transformation prospects of steel companies and make informed judgments.

Current situation of China's steel enterprises in pursuing "green"

my country's steel companies are in the initial stage of pursuing "green", and a few companies have taken the lead in arranging low-carbon transformation process transformation, especially Baosteel. Baosteel's transformation journey began in 2020. After four years of hard work, its low-carbon transformation has begun to show results.

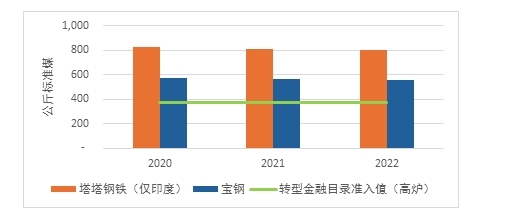

Judging from the technical classification of low-carbon transformation, Baosteel's initial transformation measures mainly focused on "extreme energy efficiency" in the "Shanghai City Transformation Finance Catalog." Through multiple technologies in coking, sintering and pelletizing, blast furnace, converter and electric furnace processes, Baosteel can fully recover and utilize residual heat and energy, thereby achieving extreme energy efficiency in all aspects of steel smelting. Here, we can clearly see Baosteel's transformation efforts by comparing Baosteel with India's Tata Steel. As the figure below shows, Baosteel's production capacity is similar to that of Tata Steel, but its energy consumption performance has been far better than that of Tata Steel for three consecutive years since 2020.

However, improving energy efficiency is only the first step on the carbon reduction path for steel companies. According to feedback from Baosteel's internal personnel, Baosteel can theoretically reduce carbon emissions by up to 20 million tons by improving energy efficiency. Baosteel's public data shows that this emission reduction will only account for 22% of Baosteel's overall carbon emissions in 2021 (Scope 1 and Scope 2). As shown in Figure 1, compared with the energy consumption access value of the steel smelting blast furnace process in the Shanghai Transformation Finance Catalog, Baosteel's energy consumption level is still much higher. Therefore, in addition to improving energy efficiency, steel companies also need to further transform low-carbon process equipment to achieve the remaining 80% carbon reduction target.

Figure 1 Comparison of energy consumption levels between Baosteel and India's Tata Steel

In terms of the construction of new production process equipment, starting from 2020, Baosteel will convert a 430-cubic meter conventional blast furnace into a new hydrogen-rich and carbon-cycle blast furnace, and expand it to 2500 cubic meters in 2023, achieving a reduction of carbon in the ironmaking process. 30%. At the end of 2021, Baosteel will build a hydrogen-based shaft furnace at its Dongshan base to develop a hydrogen metallurgical process, combined with the supporting zero-carbon power in the South China Sea region; compared with the traditional long-process smelting process, the carbon reduction effect brought by the construction of this part of equipment is expected to be more than 90%. However, these low-carbon transformation equipment is expensive, but its contribution to total output is quite limited. For example, Baosteel's total investment in hydrogen shaft furnace projects is 1.89 billion yuan, but its annual crude steel output only accounts for 2% of the company's total output.

It is worth noting that although my country's steel companies have begun to achieve results in the adjustment of technical processes, there is much room for improvement in the disclosure of transformation information. Through public channels, this paper compiles the carbon emission information of the top ten listed steel companies in my country, which is shown in Table 2. Among the 10 companies, 7 have issued carbon reduction targets, but only 4 of them have clarified short-and medium-term carbon reduction goals and paths. In terms of information disclosure on greenhouse gas emission performance, the situation is also not optimistic. Among the 10 companies, 5 disclosed the intensity of greenhouse gas emissions in accordance with the principle of sustainable steel, 3 only disclosed total emissions, and 2 did not make any disclosure.

In this regard, Baoshan Iron and Steel, Ma 'anshan Iron and Steel and Shanxi Taigang have relatively complete disclosures. They have all disclosed short, medium and long-term carbon reduction goals and paths, as well as emissions and emission intensity for more than three consecutive years. In contrast, the worst disclosures were Hegang and Shougang, and most of the projects in Table 2 were not disclosed. Among them, although Hegang Co., Ltd. stated that it had set carbon neutrality goals, it did not provide any relevant action plans and digital support, which aroused doubts. In addition, among the 10 listed steel companies, except for Baoshan Iron and Steel, which disclosed some range of three-carbon emissions, the other 9 companies did not disclose them at all. Scope 3 covers upstream and downstream emissions in the value chain of steel companies, including upstream mining and downstream processing. Although relevant figures are not easy to collect, it is currently the focus of global attention. Its completeness can particularly reflect a company's carbon inventory efforts and international standards. degree of integration.

Table 2 Carbon emission information disclosure of the top ten listed steel companies in China

Note: The source of the data in the table is the latest edition of the company's public annual report

Overall, under the trend of "green", leading companies in the domestic steel industry have taken positive actions, indicating that they have improved energy efficiency and adjusted technical processes. However, the disclosure performance of the domestic steel industry is poor, and the scope and content of disclosure need to be improved urgently. Of course, compared with Europe and the United States, domestic companies have started late in disclosure practice, so that most steel companies are still learning.Xiand the adjustment phase. However, based on international experience, sound information disclosure can help companies obtain financial support.

Domestic steel companies are leading in practice but lagging behind in disclosure, which is often the reason why international scores are lowered. For example, judging from TPI's rating on the transformation of steel companies, out of a total of 5, Tata Steel scored 4 points and Baosteel only scored 3 points. Baosteel's energy consumption performance is far better than Tata, but its overall TPI score is actually worse than Tata. The reason behind this should be related to Baosteel's insufficient disclosure. In particular, Baosteel did not publicly disclose information such as internal carbon prices and climate performance evaluations of executive compensation. In contrast, Tata has disclosure pressure from international institutional shareholders, so its disclosure is far better than Baosteel. TPI is well recognized by the international community, and its transformation score is often regarded as the focus of investment decisions by employers. Steel companies with international financing needs should learn from it.

Conclusion and Outlook

This article takes the steel industry's pursuit of "green" as its title, explaining that under the green direction of its low-carbon transformation, all parties have set sail; the government has introduced "green" standards, investors have launched "green" assessments, and steel companies have taken "green" actions. However, steel is a key industry for carbon emission reduction and an asset-heavy industry. Its low-carbon transformation is bound to be full of thorns and the road ahead will be arduous. So, based on the above, what are the promotion matters for all parties?

First of all, steel companies can start with the steel industry transformation policies and technical guidelines issued by the government, but they should take further and more active actions. In particular, to truly implement low-carbon transformation, steel companies must formulate specific and feasible short-, medium-and long-term goals and carbon reduction strategies, supplemented by adjustments in green investment plans and company internal management. At the same time, in order to gain the favor of investors, steel companies must strengthen disclosure, especially target planning, capital investment and action performance data related to low-carbon transformation.

Secondly, financial institutions can use the existing carbon neutrality docking assessment as a starting point, but should further develop a more optimized framework and even incorporate some elements that better reflect the uniqueness of the transformation of the steel industry. As mentioned earlier, the current evaluation uses a universal framework, mainly based on the company's information disclosure and the company's performance scoring of data providers, but there are many related unknowns. Among them, one of the unknowns is the reference benchmark for long-term transformation planning of enterprises. Currently, due to lack of data, there is a lack of benchmarks. Another unknown is the indirect investment in the value chain involved in the transformation of steel companies, including the amount of investment in renewable energy, carbon storage facilities, zero-carbon power generation facilities and other infrastructure. Currently, it is difficult to accurately estimate because models have not been built. Therefore, how to overcome these obstacles in the future is an issue that financial institutions urgently need to think about.

In the end, it goes without saying that the government plays a key role in steel's pursuit of "green". The government can issue guidelines for the transformation of the steel industry as a starting point, but it should further supervise the transformation actions and disclosures of steel companies and encourage financial institutions to carry out carbon neutrality docking assessments so as to guide funds to invest in truly transformed steel companies. Judging from the current situation, although the "landmarks" of transformation that have been introduced all emphasize action and disclosure, relevant supervision and punishment mechanisms almost do not exist. At the same time, domestic asset management institutions have not only failed to adopt the carbon neutrality docking assessment that has been rising for some time in the world, but also failed to encourage it in official documents. In view of this, it is suggested that the government should face up to the problem and actively play its functions of guidance, supervision, encouragement and restraint.

The goal of carbon neutrality is arduous. Only through the cooperation of the government, enterprises, investors and investors, working hand in hand, and firm direction can we break through difficulties, ride the wind and waves, and face the prosperity.

The author Qiu Ciguan is a professor at the Shanghai School of Advanced Finance of Shanghai Jiao Tong University, academic director of the Special Fund for Sustainable Finance Discipline Development, and an expert member of the Green Finance 60 Forum (GF60); Li Xiaoqian is a researcher at the Special Fund for Sustainable Finance Discipline Development