dual carbon focus| Carbon quotas are tightened, how can power generation companies manage carbon assets?

The carbon market is an important policy tool to address climate change. Currently, there are 28 carbon markets in operation around the world, covering 55% of the world's GDP and 1/3 of the world's population. Well-known energy companies such as BP, EDF, and Shell have established mature carbon asset management systems. my country's carbon market is the largest carbon market in the world. It has included 2257 power generation companies, covering carbon emissions of more than 5 billion tons, and the carbon price remains at 50 yuan/ton to 90 yuan/ton.

As the constraint and incentive mechanism of the National Carbon Emissions Trading Market (hereinafter referred to as the National Carbon Market) continues to improve, the impact on the production and operation of power generation companies has gradually turned from weak to strong, and the need to carry out carbon asset management has become more urgent.

Development trend of national carbon market

With the advancement of the "double carbon" process, it is expected that the national carbon market will go through development stages such as rapid adjustment period, development and improvement period, and mature operation period. The quota allocation mechanism, coverage industries, offset mechanism and carbon prices will continue to be optimized and improved, and the carbon market will encourage emission reduction functions will be continuously strengthened.

Carbon emission quotas will be tightened year by year

The allocation of quotas during the first performance period of the national carbon market was relatively loose, with a surplus of nearly 7%, and market transactions were inactive. The second performance period is to absorb surplus quotas, and the scale of quota issuance has been significantly tightened, with a tightening rate of 8%. The total quota volume has been reduced by about 400 million tons every year. The supply and demand of quotas have shifted to a tight balance, and market activity has increased. In the future, the issuance of quotas in the national carbon market will follow the principle of "moderately tight and step-by-step". Taking into account factors such as the narrowing of the technological carbon reduction space in the power generation industry and the pressure on energy supply guarantees, it is expected that before 2030, the benchmark value of quota allocation in the power generation industry will be based on the annual 0.3% to 0.5%.

Paid quota allocation is gradually introduced

Currently, the national carbon market is in its infancy, and all quotas are allocated free of charge. Referring to the development experience of European and American carbon markets and domestic pilot carbon markets, after the market operates stably, it is necessary to introduce a paid distribution mechanism in a timely manner and gradually increase the paid distribution ratio, so that carbon prices can be better discovered and the carbon market's emission reduction function can be exerted. The allocation of quotas in the national carbon market will gradually transition from "100% free allocation" to a "mainly free allocation and supplemented by paid allocation" approach. It is expected that by the end of the "14th Five-Year Plan", the power generation industry will take the lead in introducing a paid distribution mechanism, with a paid distribution ratio of 5%. During the "15th Five-Year Plan" period, the paid distribution ratio of the power generation industry will gradually increase to 25%.

Other high-emission industries are included in an orderly manner

From an international perspective, the carbon market generally covers the power and industrial sectors, and some are also included in the construction and transportation sectors. For example, the EU carbon market mainly covers electricity and heat, energy-intensive industries, aviation, shipping and other industries. From a domestic perspective, the realization of the "double carbon" goal requires all industries to jointly reduce emissions, and more high-emission industries will be included in the carbon market. It is expected to give priority to industries with large emission reduction potential, serious overcapacity, and good data quality foundation. Based on comprehensive judgment, the order in which the national carbon market is included in other high-emission industries is: building materials, nonferrous metals, steel, petrochemicals, chemicals, papermaking, and aviation. Among them, the "14th Five-Year Plan" is expected to include the cement (building materials), electrolytic aluminum (nonferrous metals) and steel industries; the "15th Five-Year Plan" will include other building materials industries, other nonferrous metals industries, papermaking and most chemical and petrochemical industries; the "16th Five-Year Plan" will include aviation and other industries, and the carbon market will exceed 8 billion tons.

CCER trading restarts and expands

The National Certified Voluntary Emission Reduction (CCER) has been officially restarted this year. In the future, key support areas will continue to focus on renewable energy, forestry carbon sinks, marine carbon sinks, methane emission reduction and energy conservation and efficiency improvement projects, gradually meeting diverse market demand potential.

The first is to participate in the carbon market offset mechanism to support low-cost performance by emission control enterprises. At present, the annual maximum CCER demand in the national carbon market is about 250 million tons in the power industry alone. In the future, the annual demand will exceed 400 million tons after being included in all key industries. However, as the carbon neutrality process progresses, the offset mechanism may gradually weaken, especially to avoid CCER-like offset ratios that may gradually weaken and return to zero. The second is to participate in voluntary emission reduction transactions to meet the supply chain emission reduction of multinational enterprises and foreign trade enterprises, as well as the carbon neutrality commitments and personal investment needs of voluntary emission reduction enterprises. The third is to join the international mutual recognition system of carbon credits and become a mainstream product for my country to participate in the sustainable development mechanism under the Paris Agreement, the international aviation carbon offset and emission reduction mechanism, and to carry out two-way links with other regional carbon markets.

Carbon prices are gradually rising

Carbon prices are determined by the supply and demand relationship of quotas, and are mainly affected by factors such as climate goals, total quotas, paid distribution ratio, energy structure, and power demand. But fundamentally, the carbon market is a policy market, and long-term price trends are determined by the government taking into account economic development and climate target regulation. To achieve the "double carbon" goal, my country has large emission reduction needs and high speed requirements. It needs to increase the level of carbon prices to encourage the whole society to reduce emissions. In addition, the implementation of high-carbon price tariffs by countries such as Europe and the United States has created long-term upward pressure on my country's carbon prices.

Our country will take into account the cost of carbon emissions and steadily push up carbon prices. According to joint research by Huaneng Energy Research Institute and Tsinghua Sichuan Energy Internet Research Institute, it is expected that the national carbon market price will reach 70 yuan/ton to 100 yuan/ton during the "14th Five-Year Plan" period, and reach 76 yuan/ton ~155 yuan/ton, rising to a maximum of 600 yuan/ton before 2040.

Performance situation and challenges faced by power generation companies

As the only entity controlling emissions, power generation companies have successfully completed the payment of quotas in two performance cycles. The cumulative quota transaction volume is 442 million tons, with a transaction volume of 24.9 billion yuan, and a performance rate of over 99%. However, with the trend of tightening quota space in the national carbon market, increasing performance costs, limited low-cost performance channels and significantly differentiated regional carbon asset quality will bring new challenges to the operation and management of carbon assets of power generation companies.

Quota gaps and performance costs are increasing year by year

Performance costs include the cost of participating in paid auctions of quotas and purchasing gap quotas. We calculate the annual performance costs for the power plant to achieve 100% performance without considering the use of CCER offsets and surplus quota performance.

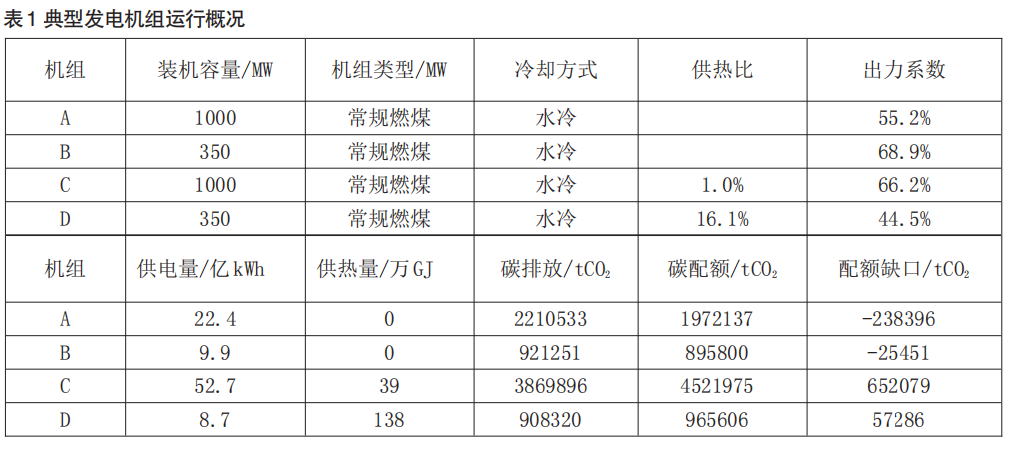

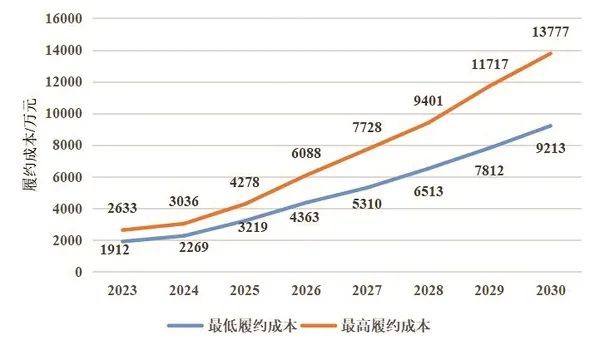

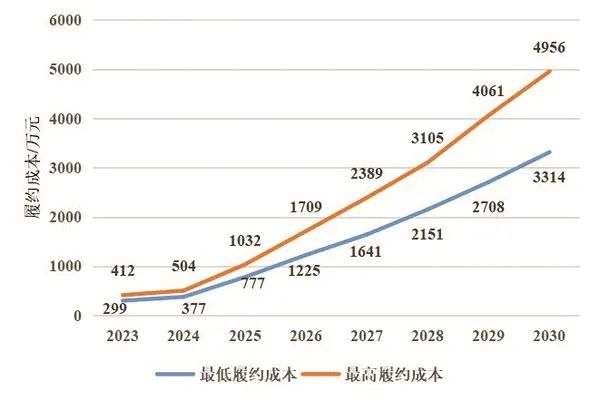

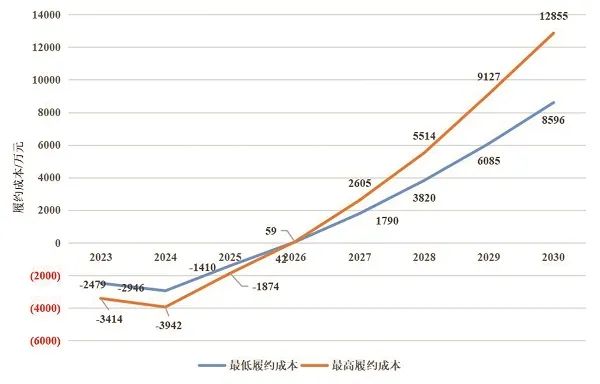

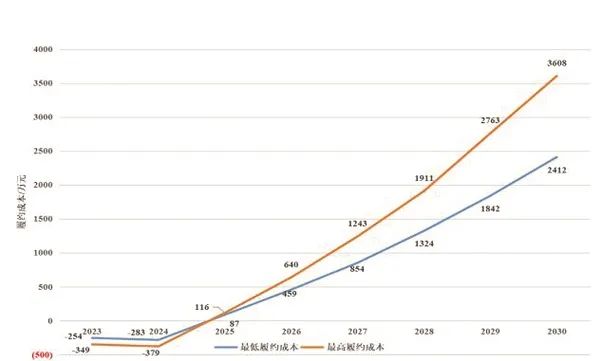

In this paper, four typical units of a power generation enterprise, including pure condensation units, cogeneration units, large-capacity units, and small-capacity units, are selected as the research objects (as shown in Table 1). Combined with the company's production and operation status and development plan, the quota gap and performance costs of each power plant before 2030 are calculated (as shown in Figure 1).

Figure 1 Performance costs from 2023 to 2030

The tightening of national carbon market quotas has led to a rapid increase in compliance costs. The performance costs during the "14th Five-Year Plan" period mainly depend on the quota allocation benchmark. The quota gaps of units A, B, C and D in 2025 are 325,000 tons, 57,000 tons,-421,000 tons (surplus), and-38,000 tons (surplus) respectively. The performance costs are 32 million yuan to 43 million yuan, 8 million yuan to 10 million yuan,-14 million yuan to-19 million yuan (surplus), and-870,000 yuan to-1.16 million yuan (surplus). The performance costs during the "15th Five-Year Plan" period mainly depend on the quota allocation benchmark and the proportion of paid auctions. The performance gaps of units A, B, C and D in 2030 are 339,000 tons, 68,000 tons,-425,000 tons (surplus),-32,000 tons (surplus), and the performance costs are 65 million yuan to 94 million yuan, 22 million yuan to 31 million yuan, 38 million yuan to 55 million yuan, and 13 million yuan to 19 million yuan respectively.

The lack of smooth transmission chain of electricity and carbon prices increases the pressure on business operations. By 2030, the carbon cost of A, B, C, and D units will account for approximately 11%~16%, 8%~13%, 4%~6%, and 7%~11% of revenue. Under the price mechanism of "benchmark price + floating up and down" and floating up no more than 20%, and the electricity prices of high-energy-consuming enterprises are not limited by the floating ratio, this part of the carbon cost basically has the function of transmitting to downstream users. However, with the whole society maintaining stable expectations for electricity prices, a substantial increase in electricity prices will face greater resistance, and the relevant carbon costs will still be borne by power generation companies, affecting the stable production and operation of power plants.

The heating potential of large-capacity coal-fired power units needs to be released urgently. Judging from all the units included in the national carbon market of the case enterprise, the thermal power units with surplus quotas are characterized by high heating ratios, high load ratios, and large installed capacity. Among them, among conventional coal-fired units of 300,000 kilowatts and below, units with quota surplus account for about 40%. Especially for small-capacity units in Northeast China, the heating ratio of up to 80%, and the power supply quota surplus ratio reaches up to 160%. However, the heating ratio of cogeneration units above 300,000 kilowatts is generally low, and the proportion of units with surplus quotas is significantly lower than that of small-capacity units below 300,000 kilowatts.

Limited channels for low-cost performance

Developing self-sustaining CCER has limited effect in alleviating compliance pressure. According to the "Methodology for Voluntary Greenhouse Gas Emission Reduction Projects Grid-connected Offshore Wind Power Generation (CCER-01-002-V01)", the applicable conditions for offshore wind power projects are power generation projects 30 kilometers away from the shore or with water depths greater than 30 meters. Taking into account factors such as the stricter CCER development conditions for offshore wind power and the reduction of grid benchmark emission factors year by year, there is certain uncertainty in the CCER development potential of offshore wind power generation companies.

It is difficult to use carbon financial derivatives to lock in carbon costs. Financial derivatives such as futures can effectively stabilize energy prices. For example, EU natural gas futures, carbon futures, and electricity futures contracts account for more than 90% of the trading scale in their respective markets, providing stable market expectations for thermal power companies. Since 2012, my country has successively introduced long-term coal and medium-and long-term power trading. Among them, long-term coal has covered 80% of my country's total thermal coal supply, and medium-and long-term traded electricity accounts for more than 90% of market-oriented electricity, giving full play to the role of coal power. The ballast stone role of stable operation. Carbon emission costs have increasingly become one of the important production and operation costs of power generation companies. As carbon prices in the national carbon market rise and the scale of emission control companies increases, the risk of carbon price fluctuations increases. It is necessary to develop a carbon futures market to support power generation companies to manage carbon cost risks.

The quality of carbon assets shows differentiation

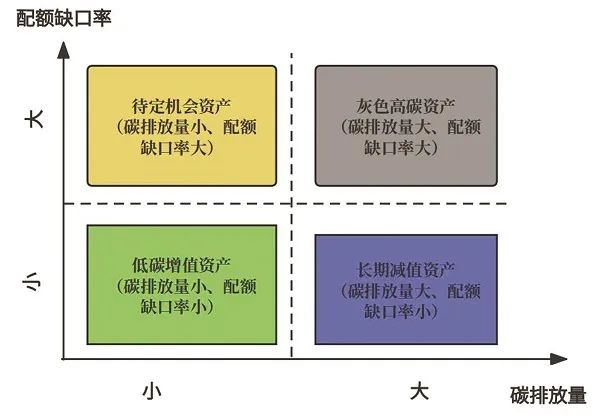

This paper uses the four-quadrant matrix analysis method to classify and evaluate the carbon assets of different power generation companies based on the two dimensions of carbon emissions and quota gap rate indicators, as shown in Figure 2.

Figure 2 Classification and evaluation system for carbon assets of power generation enterprises

Units with large carbon emissions and large quota gap rates are gray and high-carbon assets. Such assets correspond to a relatively high unit power generation. By 2030, they will face the dual pressure of ensuring energy supply and carbon market compliance. It is urgent to optimize the power supply structure, implement energy-saving and carbon-reduction renovations, and increase the proportion of low-carbon clean energy power generation., etc., significantly reduce carbon emissions levels.

Units with small carbon emissions but large quota gap rates are among outstanding opportunity assets. Such assets correspond to a high level of coal consumption of units, and carbon costs account for a large proportion. Enterprise production and operation are highly sensitive to changes in carbon prices. It is urgent to implement energy-saving and carbon-reduction renovations to reduce carbon emissions from kilowatt hours and effectively reduce production and operation caused by performance. risk.

Units with large carbon emissions but small quota gap rates are long-term impaired assets. The overall carbon emission intensity of such assets is low, performance costs account for a relatively low proportion of production and operation costs, and the company's performance pressure is relatively small. Especially in the early stage of operation of the national carbon market, value-added benefits can be obtained through surplus quotas. However, considering the large total carbon emissions, as carbon prices accelerate in the long term, the space for unit technology emission reduction narrows, and the proportion of paid quota auctions expands, we still face the risk of stranding high-carbon assets.

Units with small carbon emissions and low quota gap rates are low-carbon value-added assets. You can make full use of the offset mechanism and quota-CCER swaps to reduce the company's performance costs, or obtain value-added benefits through surplus quotas.

Suggestions on carbon asset management of power generation enterprises

In the process of realizing "double carbon", the impact of the carbon market on the production, operation and transformation and development of power generation companies has deepened day by day. Carbon asset management has become an important starting point for power generation companies to respond to the challenges and opportunities of the carbon market and enhance their core competitiveness. It is recommended that power generation companies comprehensively improve their carbon asset management capabilities from the strategic, organizational, institutional, operational, transaction, technology and regional company levels.

Strengthen organizational leadership and institutional guarantee for carbon asset management

Establish a carbon asset operation and management leading group, composed of relevant members such as planning, treasury, law, marketing, production, science and technology, and research. It is mainly responsible for guiding and coordinating carbon asset operation and management, reviewing carbon asset strategies, plans and important systems, etc., Coordinate and resolve major issues in cross-departmental carbon asset operation and management. Build a three-level management structure of "headquarters + regional companies + grassroots power plants" for carbon assets, and improve working mechanisms such as transaction authorization, risk management and control, and compliance management. Keep up with changes in national carbon market policies, optimize and improve corporate carbon emission statistical accounting, data quality management and standard systems, carbon asset trading management methods, etc., and consolidate the guarantee of the carbon asset management system.

Strengthen the full-process operation and management of carbon assets

Adhere to the concept that carbon assets and physical assets are equally important, and integrate carbon asset management throughout the entire process of enterprise operation and development. In the planning and budget process, carbon quotas, performance costs, and carbon asset benefits are incorporated into the enterprise's comprehensive budget system, and the carbon strategy is integrated into the enterprise's daily production and operation through the budget management system. In the investment decision-making process, establish a rolling adjustment internal carbon price mechanism to incorporate carbon emission costs and CCER benefits into the project investment evaluation system. In the production and operation process, we will take into account the situation of the fuel market, electricity market and carbon market, and jointly optimize production and operation strategies such as fuel procurement, power generation methods, electricity bidding, and quota transactions with the goal of maximizing comprehensive benefits. In the performance appraisal link, an incentive mechanism for carbon asset operation and management assessment will be established, and indicators such as data quality, energy conservation and carbon reduction, performance costs, and carbon asset return rate will be incorporated into the performance appraisal system to form a long-term driving mechanism for improving carbon asset operation and management capabilities.

Focus on improving the level of carbon asset operations and trading

Carry out in-depth carbon asset inventory, find out the company's carbon assets, analyze and evaluate the quality of carbon assets, and establish a unified digital carbon asset management platform. Strengthen the intensive management of corporate carbon quota trading performance, follow the principle of maximizing the overall interests of the group, and adhere to the principle of "internal adjustment first, then external transactions" and "CCER offset first, then quota performance". Strengthen research on carbon market policy situations, scientifically formulate carbon trading strategies, purchase and reserve carbon quotas at low prices, use carbon futures and carbon forward-looking tools to achieve hedging, and develop financing channels such as carbon bonds, carbon asset collateral, and carbon asset repurchase. Make full use of the CCER offset mechanism, accelerate the development of CCER assets for offshore wind power and solar thermal power generation, and lay out potential CCER projects such as carbon sinks, methane utilization, and biomass power generation in advance.

Accelerate the promotion of low-carbon, zero-carbon and negative carbon development of coal and electricity

Accelerate the transformation of coal-fired power into supporting regulatory power sources, vigorously implement energy conservation, carbon reduction, flexibility and heat supply transformation, and improve the energy efficiency level and economy of deep peak shaving of coal-fired power units. Use advanced technologies such as molten salt energy storage and supercritical carbon dioxide cycle power generation to further improve the cleanliness, flexibility and efficiency of coal-fired power units. Accelerate the research and development and demonstration of key technologies such as high-proportion biomass blending, ammonia blending, CCUS, and BECCS. Reasonably plan the scale and timing of unit decommissioning and life extension, and orderly promote the zero-carbon-negative transformation of existing coal-fired power units.

Classified policies to improve the quality of carbon assets

Gray and high-carbon assets insist on paying equal attention to technical emission reduction and market emission reduction, and promote the "double reduction" of the total amount and intensity of carbon emissions as soon as possible. Opportunities for assets to be determined focus on implementing energy-saving and carbon-reduction renovations, tapping the potential of heating and steam supply, and reducing the carbon emission intensity of units. Long-term impaired assets focus on new energy power generation, continue to optimize the power supply structure, gradually shut down old units with high energy consumption levels, long service lives and poor economic returns, and control the total carbon emissions of thermal power. Low-carbon value-added assets can flexibly trade to obtain value-added benefits while performing at the lowest cost.

(Author's units: Zhou Nan, Yang Yang, Zhao Liang, Qiu Bo, Energy Research Institute of China Huaneng Group Co., Ltd.; Chang Ming, Guangdong-Hong Kong-Macao Ecological Environment Science Center; Qiu Bo is the corresponding author of this article)