Reveal the reasons for the sharp rise in carbon prices, and analyze the five current conditions and eight development directions of the national carbon market

Starting from July 2023, China's carbon price has been rising all the way, and has exceeded 80 yuan/ton for many consecutive trading days. Zhang Zhongxiang, founding dean of the Ma Yinchu School of Economics of Tianjin University, pointed out that this is the result of the superposition of five factors.

1. Compared with the previous performance cycle, the performance time is about a month earlier. The Notice on Doing a Good Job in the Allocation of National Carbon Emission Trading Allowances in 2021 and 2022 ensures that 95% of the key emitting enterprises in the administrative region will complete the compliance by November 15, 2023, and all key emitting enterprises will complete the compliance by December 31. The requirement for the first compliance cycle is that 95% of the key emitting enterprises in the administrative area complete compliance by 5 p.m. on December 15, 2021.

2. According to the experience of the carbon pilot and the first compliance cycle of the national carbon market, the enterprises participating in the transaction mainly aim to perform the contract, and the transaction volume is obviously driven by the performance.

3. The supply of carbon allowances has tightened. In the second compliance period, the benchmark value of quota allocation for power generation enterprises has been lowered, resulting in a quota gap for more emission control enterprises, resulting in a further increase in market demand.

4. Reluctance to sell. Because the 2019-2020, 2021 and 2022 allowances held by key emitting entities can be used for 2021 and 2022 settlement and performance, as well as for trading, and the existing allowance stock is limited and the future allowance is expected to be further reduced, the key emitting enterprises will cherish their quotas more and choose to sell them for future performance considerations.

5. The supply of national certified voluntary emission reductions (CCER) is limited. It is estimated that only more than 10 million tons of CCER will be retained in the market, and Zhang Zhongxiang particularly stressed that after the resumption of CCER, it is impossible for any newly issued CCER to meet the quota offset of the second compliance period of enterprises.

According to industry experts, there are eight major development directions for the national carbon market in the future.

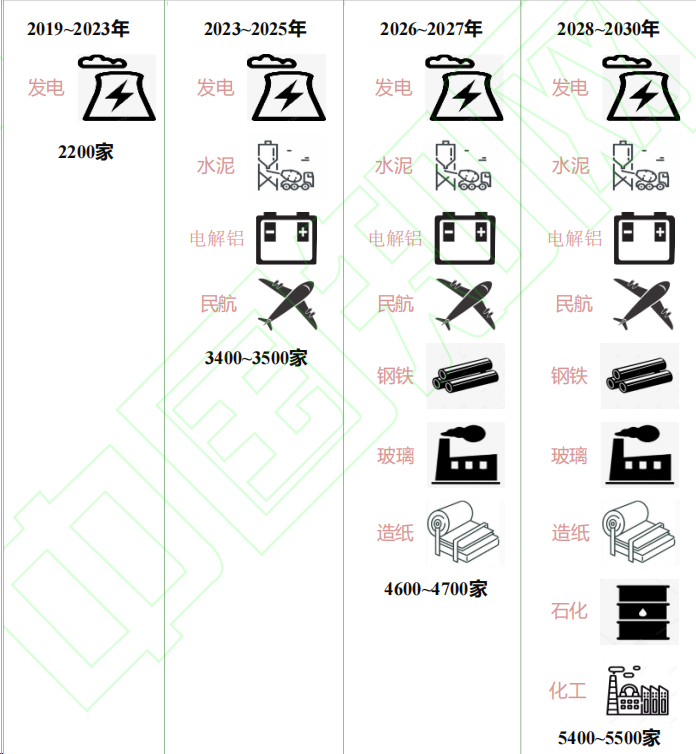

1. Expand the coverage of the industry and include other industries in echelon

It is expected that the national carbon market will further expand the coverage of industries, including cement, civil aviation and electrolytic aluminum industries during the 14th Five-Year Plan period, and steel, papermaking, glass, petrochemical and chemical industries during the 15th Five-Year Plan period.

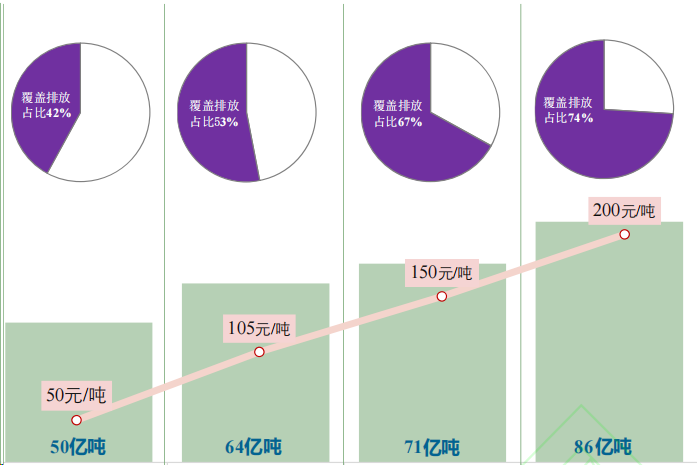

It is expected that during the 14th Five-Year Plan period, the national carbon market will take the lead in including the three industries of cement, electrolytic aluminum and civil aviation, the number of enterprises covered by the carbon market will increase from the current more than 2,200 to more than 3,500, the annual covered carbon dioxide emissions will increase from 5 billion tons to about 6.4 billion tons, and the proportion of covered emissions in the national carbon dioxide emissions will increase from 42% to 53%. The average transaction price of quota is expected to exceed 105 yuan/ton, and the average transaction price of CCER is expected to exceed 80 yuan/ton.

By the end of 2030, the number of enterprises covered by the national carbon market will increase to about 5,500, and the annual carbon dioxide emissions will exceed 8.6 billion tons, accounting for about 74% of the country's carbon dioxide emissions. The average transaction price of quota is expected to exceed 200 yuan/ton, and the average transaction price of CCER is expected to rise to 150 yuan/ton.

As the coverage of the national carbon market will be further expanded, the influence of the carbon market will be significantly enhanced.

2. Optimize the quota allocation method and gradually introduce paid allocation

At present, the release time of the national carbon market allowance allocation plan and the date of allowance issuance are relatively late, which reduces the long-term expectation of enterprises to formulate allowance trading plans. It is expected that the national carbon market will completely change the mechanism of retrospective allocation of allowances "after the fact" by 2025, and establish a quota allocation mechanism for the next three to five years from 2024 to enhance the anticipation of allowance allocation.

It is expected that the national carbon market will first introduce a paid auction mechanism for allowances in the power generation industry from 2024, with an initial auction ratio of 5%~8%, and gradually increase the proportion. At the same time, we will improve the supporting system standards, clarify the key points such as the form of quota auctions, transaction rules, access rules, implementation platforms, and auction frequency, and gradually establish a fund library to support the carbon emission reduction of enterprises, carbon market regulation and control, and carbon market construction.

3. Optimize and adjust the performance mechanism, and clarify the provisions on quota carry-over

It is expected that the national carbon market compliance mechanism will be further adjusted, the quota advance mechanism may be cancelled, and the provisions on the carry-over of surplus allowances are expected to be clarified in 2024, providing long-term expectations for the management of enterprise carbon assets, and in order to reduce the performance pressure of enterprises with quota shortages, the quota allocation plan in 2021 and 2022 innovatively proposes the quota advance policy.

It is expected that the national ETS will eliminate the quota advance mechanism in 2024 and beyond. In addition, the allowance carry-over mechanism is an important part of the carbon market quota management, and the carry-over regulations will have an impact on the supply and demand of allowances and the price of allowances in the carbon market in the future.

4. The demand for CCER has gradually increased, and a number of methodologies have been released

It is expected that the demand for CCER will further increase among enterprises included in the carbon market quota management, and a number of methodologies will be released in 2024, and the upper limit of CCER offset allowance settlement will remain at 5%

With the resumption of CCER methodologies and project approvals, it is expected that more methodologies will be revised and published in 2024, and related projects related to biomass energy (waste-to-energy incineration, straw incineration power generation, etc.), methane utilization, and methane emission reduction are expected to benefit earlier.

5. Accelerate the mutual recognition and interoperability of methods and standards, and actively respond to the carbon border adjustment mechanism

It is expected that China will accelerate the connection between the national carbon market and the international carbon market, promote the mutual recognition and exchange of technologies, methods, standards and data, improve the international influence of the national carbon market, and actively respond to the EU's carbon border adjustment mechanism.

6. Innovate carbon market trading products and diversify trading entities

After the national carbon market has reached a certain level of market activity and maturity, it should gradually introduce various carbon financial products in terms of trading products, including carbon futures, carbon options and other derivative financial products, so as to effectively increase market liquidity and improve the price formation mechanism of the carbon market with diversified trading products;

In terms of trading entities, it is also necessary to introduce appropriate institutional investors, individual investors and overseas investors to increase the activity of the carbon market.

7. Improve the data quality management system of the carbon market and improve the level of enterprise emission reporting

It is necessary to further improve the data quality management system of the national carbon market. The first is to strengthen local supervision and strictly check the quality of data. The competent authorities of all regions need to attach great importance to the quality of carbon emission data, strengthen inspection and supervision, strictly investigate and deal with data quality problems, improve daily supervision, and gradually establish a standardized regulatory system. Second, it is necessary to strengthen the management of verification institutions and improve the withdrawal mechanism. Establish a grading evaluation system for verification institutions and inspectors, and strengthen supervision and management. Strengthen the capacity building of verification institutions, improve the management level of verification institutions, and improve the professional ability and professional quality of verification personnel. The third is to use the Internet of Things and blockchain information platform to realize the intelligent submission of greenhouse gas accounting data.

8. Promote the coordination of the carbon market with other policies

First, the synergy between the carbon market and the energy rights trading market. In the context of the current shift from dual control of energy consumption to dual control of carbon emissions, it is necessary to consider the exchange and mutual recognition of energy use rights and carbon emission quotas, only in this way can enterprises be given greater autonomy to choose their own favorable market transactions, and achieve the goal of energy conservation and emission reduction at the minimum cost.

Second, the synergy between the carbon market and the electricity trading market. It is necessary to deepen the marketization of electricity, especially the reform of electricity prices, so that electricity prices can truly reflect market supply and demand and emission reduction costs, promote the coordinated development of the carbon market and the electricity market, and reduce the cost of power system transformation.

Third, the synergy between the carbon market and the green certificate trading market.

It is necessary to improve the relevant rules of the national carbon market, strengthen the construction of relevant standards and systems for green certificate deductions, and do a good job in technical support for the traceability, circulation and confirmation of green certificates, so that enterprises that buy green electricity to pay for pollution externalities can pass on the cost of emission reduction from the carbon market to other high-carbon emission control enterprises that have not purchased green electricity, and truly embody the principle of "polluter pays".